On April 17th, Sina Weibo and Sina Leju both listed in the US, one on NASDAQ and one on NYSE. When Chinese stocks went public overseas last year, people used to like talking about when the stock price would climb to twice the issue price, but now, that Weibo and Leju will drop below their IPO prices today or a few days later has become the public’s concern.

Yesterday, Weibo’s stock price at the opening was below its issue price of $17, and Leju dropped below its issue price of $10 ten minutes after the opening of the market. Fortunately, they both climbed later and closed at an increased price, able to claim a US-listed success with a 19.06% or 18.60% increase.

But they are still in the danger, especially Weibo, who is doomed to suffer a lot and possibly drop below its IPO price one day. There are mainly three reasons:

1. Chinese Stocks’ Day Has Gone

Chinese stocks have had their day since 2013 – those stocks whose values rank within 25th on the market have gain an average rise of 150% as of 1Q14 — but now it’s gone.

On April 3rd, Terena Technology went public, which marked the beginning of Chinese firms’ US listing in 2014, and fell below its offering price the next day. On April 9th, iKang Guobin Healthcare Group kept struggling for three days and dropped below on the fourth day. In all, their financing comes in at less than 300 million USD and market value only about 1.2 billion USD. Their performance has heavily weakened the confidence in market.

It’s really not a good time for Weibo, with financing of $340 million and value of $4 billion, to go public now.

2. Twitter’s Slump

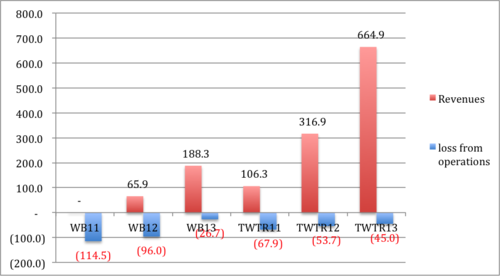

In the eyes of American people, Weibo is “China’s Twitter”. In 4Q13, Weibo had 129 million MAU (monthly active users) and Twitter had 241 million. Weibo’s revenue and profit (excluding the effect of equity incentive) equal to 28% and 59% of Twitter’s. Weibo’s $4 billion value is only one sixth of Twitter’s, which is not high in any sense.

(million USD)

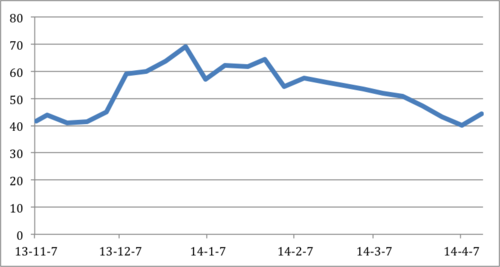

Unfortunately, Twitter’s timeline pageview met its turning point in 4Q13, down 7% from 3Q13. With the doubt on its growth, Twitter’s stock price plummeted. Its shares closed at $44.42 on April 16th with a value of 24.2 billion USD, which experienced a 33% fall from $66.32 on Feb. 4th. In the recent 50 trading days, Twitter’s market value has shrunk 12 billion USD, or say, a Qihoo 360.

Historical Price of Twitter (Weekly)

If Twitter’s future performance cannot eliminate investors’ worries, it will keep falling and exert much pressure on Weibo at the same time.

3. Sina’s Drag

Sina Weibo was born by Sina, but Weibo has to pay for being brought up.

In the financial year of 2011, 2012 and 2013, Weibo paid $45.05 million, $40.38 million, $63.07 million for marketing, among which $40.7m, $23.5m and $33.2m were the advertisement costs that composed almost all Sina’s revenue. Besides, Weibo has to pay the rent, and that of 2013 was 3.2 million USD.

According to Weibo’s IPO filings, Weibo owed Sina 393 million USD by the end of 2012, and 268 million USD by the end of 2013 thanks to Alibaba’s investment in 2013. The interests of 2011, 2012 and 2013 (financial year) Weibo should pay Sina were $1.567m, $2.923m and 6.708m – most of the $340m Weibo raised in IPO will be to pay back to Sina.

Weibo’s market value is up to 4 billion USD according to the closing price, but Weibo cannot gain much improvement with such a parent company. It might be better for Weibo to be sold sooner or later.

Original Arthur: Eastland